The amazing Siri, Apple’s new voice recognition technology, has been the topic of much conversation over the last month. I too am left speechless when asking questions that at first blush seem ridiculous. Responses to questions such as “Siri, what do you look like?” or “Siri, will you marry me?” will elicit laughter and jaw dropping looks only magicians are used to seeing.

All fun and games aside, what Apple (not Microsoft) just released represents a fundamental shift in how we will interact with computers – and to an extent the rest of the world. Even Eric Schmidt knows we will no longer type things into a long search box and wade through a sea of links to find what we “think” we are looking for. We will also not be required to re-identify ourselves and re-enter our credentials each time we want to make a digital purchase. I previously believed the future of search will be found within your loose contacts and network of friends – and still do. But in addition to leveraging others to find information, it has become very apparent we will now leverage new blends of artificial intelligence and intelligent data systems integrated within our mobile devices to create very personal consumer experiences. And we’ll accomplish this all this through simple text, voice and gestures thanks to natural language processing within your mobile. Like it or not, in a very short period of time you will not be able to properly function in society without your trusty device.

Simple and inane tasks can already be accomplished through Siri. Speaking basic directives into your phone will help to find any personal contact you have in your phone. Such things as setting reminders, alarms, meetings, checking email, checking the weather, searching the web to look up random information and interestingly enough just having a plain conversation with your phone can now be done by voice dictation.

Simple and inane tasks can already be accomplished through Siri. Speaking basic directives into your phone will help to find any personal contact you have in your phone. Such things as setting reminders, alarms, meetings, checking email, checking the weather, searching the web to look up random information and interestingly enough just having a plain conversation with your phone can now be done by voice dictation.

And the big one – sending text messages to others by speaking to Siri – has the potential to change society in ways you never thought possible. A quick spoken message gets translated into text and sent off to the exact recipient you have determined, all without clicking or finger swiping anything is simply amazing. And it’s now here.

Siri (or nicknamed Hubotsiri) is the latest in a long line of iOS features to be stretched to the limits, enhancing functionality, capability, and allowing users to realize the full potential of technologies within their devices. Much like buying a Ferrari – you pay a lot, it looks nice, runs well and oozes luxury. Yet until you get it off-road, you can’t really see what it’s capable of due to the restrictions beset upon road users.

As impressive as Siri can be, we still hear naysayers balking at the current ineffectiveness of the technology. They say it’s not perfect, it can’t yet complete complex tasks such as interacting with the Apps on your device, and when in doubt it defaults to a web search for your request. Although I am fascinated with Siri I must agree we have only scratched the surface and more work is ahead.

It seems Apple has figured out how to voice activate basic tasks, but what about more practical applications that can make your everyday life easier and more fluid? How will voice translation and Artificial Intelligence radically transform how you go about your everyday life? Below is an attempt to peel the layers on what it will take for society to get away from the absurd and onto the applicable.

Siri, Can You Please Make My Life Easier?

Siri, Can You Please Make My Life Easier?

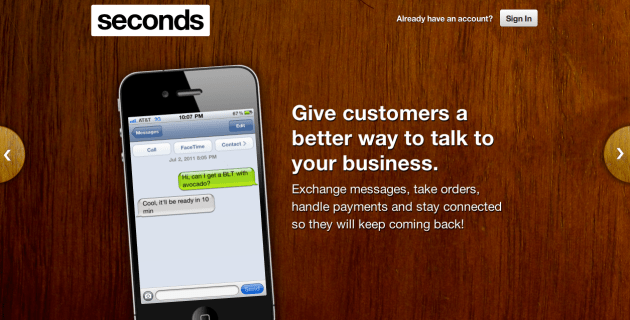

Imagine being able to say things like “send a message to the coffee shop and tell them I will be there in 10 minutes and I will have the usual” and by the time you get there your correct drink it sitting on the counter already paid for. This is not too far off… it just requires a few more pieces to be put in place.

The answer lies in understanding what exactly Siri is, what exactly are those other pieces, and how they need come together for the above scenario to become reality. Siri is basically a search engine, one many think has the potential to eat Googles Lunch. Or better said, it’s a “do” engine in the sense that you can dictate what you want done and Siri will mostly carry out the task. I say mostly because even though Siri represents the first mile, the possibilities can only become reality when something else comes in as the last mile to fulfill your request. Siri can accomplish any task as long as the information is readily available and in the correct form to be delivered to the user. Would Google have worked so well if there were no links to bring back?

So for Siri , or any AI from a mobile device for that matter, to connect and help you easily communicate with your local community the last mile must be completed in a way that makes sense for Siri. One can communicate with Siri in audio/voice, yet Siri communicates with databases and other systems via bits. The last mile must be accessible via the web, enabled to send and receive text based communications, and ultimately be built from the ground up using data as the foundation.

We can see from the article How Siri Works we have a long way ahead to complete the last mile. Siri can’t understand everything. It can do a certain set of key tasks. From the article:

- Interact with the calendar.

- Search contacts.

- Read and write messages (text and email).

- Interact with the Maps app and location services.

- Forward search phrases to certain pre-defined data providers (Yahoo! Weather, Yahoo! Finance, Yelp, Wolfram|Alpha, or Wikipedia).

This is still an impressive and—most importantly—wildly useful set of functions. But it is a limited, focused set. And that’s what makes me think Siri’s “AI” may actually work.

It seems to me that Siri consists of three layers: a speech-to-text analyzer, a grammar analyzer, and a set of service providers. If all three of these work well, then Siri will be fun and helpful. If one of them is as troubled as traditional intelligent agents have tended to be, then Siri will go the same way those other agents went—tumbling into the trash heap of misguided innovations.

Unfortunately, most of the rest of the world does not make sense to Siri. Yet. Although searching Google will bring back (s0me sort of) local merchant website for most entities in the U.S. and around the world, they are still stuck in the analog world when it comes to communication, interaction or commerce. Most merchants still require a voice call to reach them and when wanting to transact, one must be present with cash or credit card. “Forward thinking” merchants offer online and mobile app transaction options, yet the experience is so cumbersome most people give up and take the extra time to physically make the purchase.

Siri will truly transform your life once the last mile is complete.

Ironically the traditional telephone served as the last mile for quite some time, when the most popular connection between two recipients was voice line. Voice ruled the land until data – better known as text messaging – became the most popular mode of communication for our new society. Although the web is based in ‘telephone’ connection, we now communicate in a vasty different language. It is interesting to note more than 2.2 trillion text messages were sent in the last year, yet little to none were received by local merchants.

Yeah, you read that right. Imagine that, the most popular mode of communication is not accepted at any place of business in your community. This would be like you walking into a merchant and asking a question in english (the obvious main language here in the United States) and they don’t even look at you or say a word. Yet that is exactly what is happening today with mobile messaging. The fact that more messages will be sent next year than last year, and even more will be sent the next year should be freaking out any manager or business owner right now. If consumer activities are to be automated through voice diction, short messaging and artificial intelligence then somethings need to change.

The last mile is comprised of a few major technological enhancements that, when adopted, will complete the transformation and bring this new vision into reality.

Merchants need a short messaging service

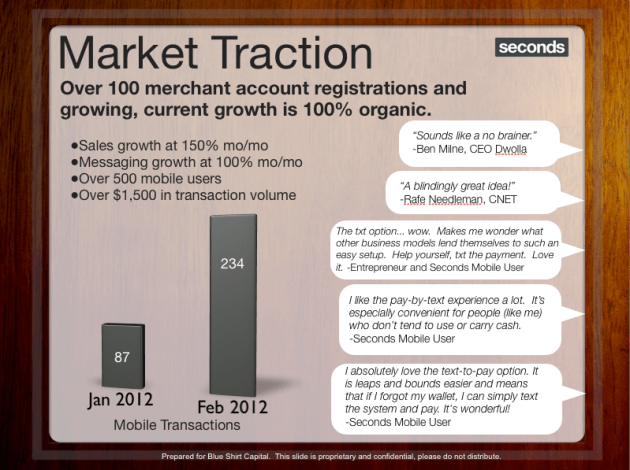

It is fair to say text messaging has taken over as the most common form of digital communication on the planet. For a bit of perspective, just look at your own life. What do you use more often with your mobile phone, text messaging or voice calls? Local merchants must get up to speed and find a simple way to send/receive text messages to optimize their business for mobile commerce. Arguably, this is a bigger deal than in the mid-90’s when everyone was touting “you need a website.” We are talking about basic communications and commerce. In the next few years we’ll see a fundamental shift in the economy as merchants and business adopt this popular method of communication and use it as new form of commerce. An interesting note: once a merchant is set up to receive text messages, mobile users are able to simply voice dictate messages to quickly place an order with the merchant using Siri. It’s awesome!

Customers and merchants need a personalized connection

Personalization and socialization are the new black on the web, yet even today when I call a local merchant they still ask me to identify myself and request I read my payment information (aloud) if I want to make a purchase. Interestingly, this does not change when I am present. As I walk in the door they have no idea who I am, how many times I have visited their location, and what my purchase history with them might look like. In a word, they are ignorant. They lack the necessary and vital information to not only improve their operations but also make my customer experience much much better.

A whole new world of possibilities opens up when personalized connections between customers and merchants is available. Customers are able to quickly find and message a merchant, requesting more information and making purchases when and where they feel most compelled. Merchants are not only afforded a more efficient method of communications, but a unique perspective on each customer and a clearer picture of their entire customer base – in real time. The possibilities are endless when local merchants fully embrace the mobile world.

Mobile Payments need to be invisible

Connections between customers and merchants are great but what both are actually looking for is the almighty transaction. The more simple and frictionless the transaction the more we, as customers, will spend. This should be music to a merchants ears yet there seems to be some resistance to employing new digital payment technologies. This challenge/opportunity falls back on the tech community, nudging us to continue on forward with our innovative genius at the helm.

Technically speaking, when a transaction occurs neither I, as the customer, or them as the merchant should have to do anything. If I have already connected digitally with the merchant and my payment credentials have already been cleared, payment should be invisible from then on. Yes other requirements such as security and merchandising are involved, but those should also be taken care of behind the scenes. But, I am so bothered right now! Why do I still need to stand in a line for them to swipe my card and require my signature before I leave? This is archaic, and if enhanced to the above scenario the merchant will not only provide a better customer experience for me but increase throughput leading to an increased bottom line.

Mobile coverage needs to improve

This one needs no justification, only a fair request to the major mobile carriers of the world. What good is Siri if I can’t get a response? Flat out, we need better coverage and we needed it like, yesterday. If mobile devices are going to be the center of our lives we cannot be at the mercy of “the number of bars” we have at a certain location or the chance opportunity we still have 3G at the top of our device. Again, we are encroaching on a time in history where if my mobile device fails me, I am hopeless. It kind of like if at certain times my Visa card worked when swiped, and sometimes it just didn’t… for no reason at all… except for maybe the restaurant was positioned on the wrong side of the street. Yeah, I know… This is absurd and it needs to change.

The above may seem crazy to some but to others like us it’s the reality we are working towards each day. We live in a truly amazing time in history and when the four things I just laid out come together… only Utopia waits.