I recently announced my plans for a 12-month Founders Live world tour. This post covers the last month and other lessons from my journey and what I have learned from taking the biggest risk of my life to date. Follow along here on this blog and here.

Hey Kid, need a ticket?

It was a Saturday afternoon and I was on a long run in the Boston heat when a recurring thought about Fenway and seeing a Red Sox game kept crossing my mind. I just felt like I needed to go that direction. Something said to me – go to Fenway and see what happens. As with the previous cities I have been in, I make sure to check out a game when time permits. Fenway is one of the oldest ballparks in the country so it was super important on my list of things to see when I was in Boston.

I rarely do these types of things by myself, I don’t really go to baseball games alone. But I thought oh well, might as well see where my luck takes me! So after my run, I got ready and headed toward the city. I navigated to the T and found the path to get to Fenway. Once I exited the subway I had a quick call with my Dad, and he was excited I was there at Fenway to see a game. I said “alright Dad, I need to get going… Let’s see if I can snag a cheap seats ticket and get into the game!”

It couldn’t have been 20 or 30 seconds after I hung up the call, as I was walking up into the box office to buy a ticket I hear a guy yelling. “Hey Kid, need a ticket?” Here you go! Take it.” I’m looking at this guy a bit weird and not 100% sure what he said. He says “don’t buy one, here’s a free ticket!” and he hands me a paper printout ticket ($85) value and says “just buy me a beer inside” then he disappears into the crowd. Shocked, I go to the entrance, get through security, give my ticket to the woman, it works, and within a few mins time I am standing inside Fenway Park to take in a Redsox game – for FREE! I was shocked and thrilled. HA!

So I grabbed some beers, went to the seats where he and his friends were sitting close to the Right Field foul pole and watched the first few innings with them before walking around the stadium. Chris was a quintessential Bostonian: friendly, couldn’t stop talking, laughable, cussin’ up a storm but light-hearted and happy. I took in the game from a few different areas of the stadium and then headed home. Chris, wherever you are – thanks man!

This story sums up my life right now – how openness and embracing the unknown leads to success. I couldn’t have known I was going to be given a free ticket when I got to the stadium… but I trusted what I was hearing on that run. I trusted enough to SHOW UP. It also sums up entrepreneurship. One must be open to new experiences, open to listening, open to their internal instinct, and open to taking risks. Open to SHOWING UP when you are asked.

In the month of July, my travels took me to Boston, Massachusetts where I reached the 16,000+ milestone and connected with my Irish roots. You can read about my June experiences here. where I transitioned from the West to the East.

I flew into Boston July 1st – went to my friend Angelica’s where I would stay for the first week of my time in the city. My first few days in Boston were magical. It was the first time I had been to the city so I was all senses open and taking it all in. We went out downtown hit the old bars and stuff saw some of the North end, which is the old Italian area and also the area where lots of historical landmarks are found. We also went to Back bay, had dinner and drinks, then walked out to the water and through the parks.

My initial take on Boston is it’s a unique city, something very special. It has a historical and forward-thinking stance to it – both at the same time – which is quite different than the younger and newer cities on the west coast. It’s obvious the summers are really great, and a perfect time to visit (I’d imagine fall is even better!) There are numerous beaches close to the city and a beautiful coastline. The city is pretty much on the Atlantic Ocean coast and near the first place I stayed was a beach on either side of me reachable within a 10 min run. Such a great spot to live.

4th of July – Angelica was out of town so I was less inclined to go out to the big 4th of July celebrations, although I do recognize 4th of July celebrations in Boston are pretty cool. So I actually didn’t do anything for the 4th and I think I went to sleep at like 7 or 8 that night. My life is full of events and pretty much a party every week so I felt it was actually best to stay in and rest that night. I’ve seen my good fair share of fireworks so I felt I wasn’t missing much.

I Stayed at Angelica’s in the Winthrop area for a week, and of course, found my running routes – yes, along the beach for sure – and got into a nice daily routine. One big thing I noticed was the lack of coffee shops, except for Dunkin’ Donuts, which really bothered me. I know this is a west coast perspective but Starbucks really did create that third place where you felt you could go in grab a bite or coffee and work for a few hours. It feels comfortable and convenient like you aren’t breaking any rules. With the proliferation of coffee shops and cafes which I now realize I take for granted in Seattle there is always a place to chill and work. Dunkin Donuts, on the other hand, is like a fast-food coffee joint more similar to a McDonalds than a Starbucks. But alas, I found myself seated at Dunkin’ at least a few days since it was the only place within walking distance where I could get some work done.

After a week at Angelica’s, I got an Airbnb in Medford for the next 2 weeks. It was fairly close to the T Orange line, I got used to using the system and getting comfortable with the city of Boston. This specific Airbnb was nice as I had my own room but was connected to a central kitchen and shared with another room in the small downstairs apartment. It was simple and worked well. That week, I went to numerous startup events such as New Technology Boston, Mass Challenge, Mass Innovation, as well as a few others.

I decided to do some sightseeing one Sunday so I went and walked the Freedom Trail and checked out the historical areas of the city. The trail is easy to navigate and follow to many cool spots. I saw the USS Constitution, Bunker Hill Memorial, Paul Revere’s house, old graveyards, state house where the constitution was signed. Boston has so much history you can feel it creaking in the wooden floors and in-between the cobblestones on each road.

One weekend mid-month, Angelica and I headed up to Portland, Maine and I was able to finally see a Lord Huron concert! They are one of my favorite bands and all year I had been looking at their tour to see where we crossed paths. The evening was beautiful, the concert was out on the lawn of a park in the middle of Portland. It was a smaller venue but a really great show. And how can you not love that picture below? I have always wondered what the “other” Portland was like since growing up in the Pacific Northwest we have Portland, Oregon. Portland, Maine is a smaller but up and coming city with lots of potential. It was cool to visit and I see lots of things sprouting up there and something to keep my eye on. Maybe we can start things up there someday soon?

After the concert, We went back to stay at Angelica’s again for another week. I originally got an Airbnb after the first stay because I didn’t want to overstay my welcome and thought I’d first stay week, and then get an Airbnb for 2 weeks and then see how we both felt. It was obvious we both wanted to still hang out and for me to stay so I came back and stayed the last week of July. Thanks again, Angelica!

We had the Founders Live Boston event July 23rd, it was a really great event held at the CiC building in Downtown Boston with maybe 125-140 people in attendance. Our city leaders Andy Jacques and Ande Lyons do an incredible job leading the Founders Live Boston team, I am very grateful and impressed with their efforts and impact on the city. AK Ikwuakor of Elete Styles won the event, they create custom made clothing for the athletic build, a consumer segment which has difficulty finding clothing that fits them appropriately. You could feel a ton of startup and founder energy in the room, it was an honor to be in attendance. I say this in each city but there is a similar response to what we are building. It’s hard to describe but I can say it feels very right and very natural and very very true. I am honored to be at the helm of something so powerful and impactful.

My time in Boston was something special and I will never forget July 2019. Thank you to all that made it what it was for me!

Oh, wait what’s this? A Random trip to NYC for the week!?

Late in July, I discovered some previous Boston plans had changed and I found myself with a few extra days on my hands. I needed to head toward DC and we also had a Founders Live NYC event on July 30th, so I decided to jump onto Airbnb and find a place to stay for 5 days, take a quick flight down to New York and within 24 hours I was in the city that never sleeps. Damn, that is a very true statement.

I decided to show up as a surprise to our NYC event. It went off well and was a fun event. Mike Smith and Sean Allen Fenn are out city leaders in NYC and they were excited to see me and as it was their first event as city leader (Mike’s anyway) it was good for me to be there and help them out a bit. The winner was Bluewave Technologies, BLUEWAVE Technologies makes an ozone infusion device to disinfect and deodorize almost anything – without using water, detergents or manufactured chemicals. It harnesses the sterilizing power of ozone, which kills germs 3,200 times faster than bleach, in a closed-loop infusion process at a speed and convenience never possible before. Overall, the event was awesome and a night all of us won’t forget.

Without sounding too much like a broken record here each new city is the same experience. It half shocks me and half feeds me. People see the dramatic potential of Founders Live and how it could impact their community and they love it. They want more of it. They want to spread it back to their own cities or home countries. Just at this one event in NYC, there were people from Botoga Colombia, from Mexico City Mexico, from Ecuador, from Kyiv Ukraine, and a few other countries who now want to talk about expanding it and starting Founders Live in their city. Whoa!

Deeper thoughts from the road:

I now more fully understand why musicians go on tour, and actually how effective they can be when they are away. It’s where they earn their money since they are dialed in and focused on the process of the show and entertainment. Touring forces you to be effective and efficient. It makes you stay on task and figure out what happens today, what you are doing tomorrow. When do we leave and where are we going? It makes you ask the question “am I being effective? Am I earning? What am I doing now, today, tomorrow to move things forward? What’s the plan? When musicians are not on tour they are most likely at home with friends and family, and probably a bit less focused. So being on the road and on tour has helped me dial in my effectiveness and processes to get shit done no matter where I am. I am loving it.

I can’t fully describe it but another wave just hit Founders Live. It feels different. Is it the East Coast? Is it the numerous people who are in Boston, DC, or NYC from other countries who attended their first event and want to expand it to their home country? Is it the growth we are seeing online and our monthly active users increasing on a weekly basis? I don’t know, but we are currently in a massive momentum swing upward, we must go with it and ride the wave as it continues to crest.

When you are open for connection, connection comes to you – I am in love with meeting new people and enjoying a unique connection with them, whether it’s for a few hours, days, or a few months. This approach is important as you navigate the world, but especially as one is touring around to new cities each month. The world will mirror you and your energy.

Nothing is more powerful than a story. You MUST create your story – no one else in the world is responsible to create and tell your story. Make it emotional and relatable. Figure out something to do – something to create – that no one else can copy and replicate. Something you can own. Then just go do it.

Lastly, I have gone from scared to courageous in the last year. In previous years I was actually scared of the future, and only now do I realize how much it was holding me back. I was scared of the thought if I failed again. I was weirdly even scared for my future success. I was scared to lose my then-girlfriend. Everything changed when I made the shift to embrace fear and embody courage. I changed from reaction oriented to action-oriented. I realized my story was up to me to create and tell, and the only thing in the way of my vision coming true was my damn self.

That realization and change, in my view, is what success is all about. Please, if you take anything from my writings and tour, its the fact that you already have the answers and the power.

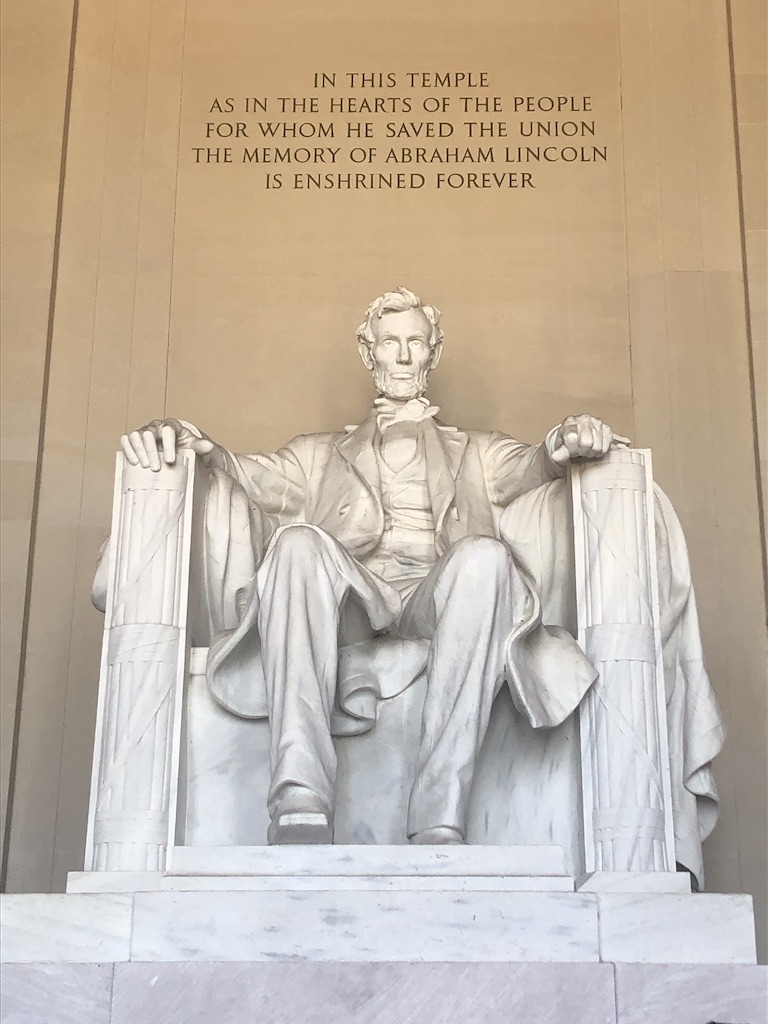

Now I am in our nation’s capital, Washington DC and enjoying more time on the East Coast before I head back to Seattle for a 2-week visit with friends and family to end the summer. (uh, where did it go?!) Then it’s back to NYC for the month of September!

Here’s to another successful month on the road.

More pics from July below.

This is a special episode of Catching Up With Conner And Nick, the weekly podcast I do with Conner Cayson.

Conner and I created this show for moments like this. To document the unexpected journey of life from a personal and professional perspective. We mostly talk about entrepreneurship from a professional perspective, but after the passing of my father this past week, we do the show in honor of him. I reflect on the entire experience from learning about his complications in London, flying back, spending his last breaths with him in the hospital, to the lessons learned from my father and how that pushes me forward to live with purpose and pursue my goals. Listen below, this is for you Dad!