The following post is an adaptation from the original one I posted on this topic in May of 2011.

I once watched an interview where Fred Wilson offhandedly noted reading a book which transformed the way he looked at markets and the web in general. I instantly went to Amazon and ordered it and spent the next week reading it front to back. Whew… it changed my life as well. I up and quit my job the next month. Thanks Fred.

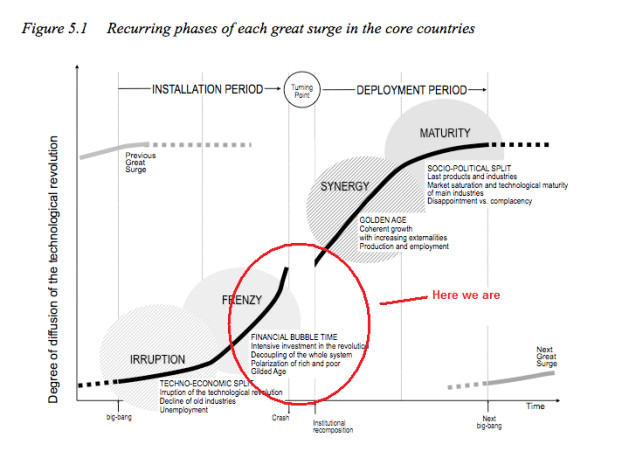

Not a day goes by in 2015 we don’t hear the word bubble in some capacity or another. We are on pace for one of the biggest years in Venture Capital deployment since the dot com bubble of 2000. Massive private funding rounds in excess of $1 billion (Uber, et al) coupled with the sickening obsession of Unicorns have created a market with flu like symptoms. Although I cannot predict the future I tend to agree with others who publicly state it feels like we are in for a correction here very soon. If you are a founder of an early stage company, it would do justice to understand the cycle we are in, where exactly we are in it, and what you should do in your specific situation.

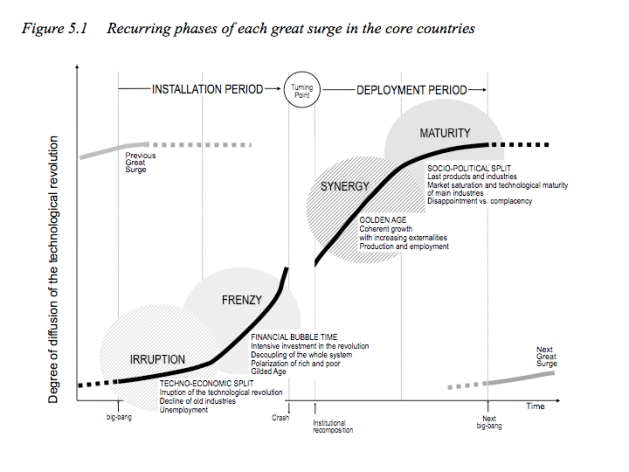

Technological Revolutions and Financial Capital by Carlota Perez is one of the greatest overviews of the incredible economic phenomenon known as the bubble. What we are currently going though – recessions and expansions, bubbles and bursts, highs and lows, whatever you want to call them – they are inevitable. In fact, the history of the entire world economy is one big cycle which repeats itself over a period of about 60 years. I cannot do this entire book justice, just take my word for it, go buy it and read it yourself. You will publicly thank me later just as I just thanked Fred now. But I will introduce the general phases a new technology (paradigm) encounters so the “layman” technologist, marketer, social media guru or business person can start to see a clearer economic picture.

I hope I am not being too being blunt, but without grasping this concept you are swimming with your cap over your eyes. You need to understand what is actually going on in this crazy economic world we live in.

Irruption

As a new technology is developed and deployed into our society, it will enter a cycle of adoption. Interestingly, Perez notes new technologies are created during the maturity phase of the last great technology expansion. So although we are starting with the irruption phase, let us take for granted the specific technology has already been created and diffused through very early adopter communities. During the irruption phase, we see a slowing or declining of the old industries and an early adoption of a new technology. Carlota notes:

The very intense activity of the new paradigm carriers contrast more and more with the decline of the old industries. A techno-economic split takes place from then on, threatening the survival of the obsolete and creating conditions that will force modernization.

Old print media anyone? Taxing industry vs Uber and other on-demand ride services? This irruption phase is started with a big bang (invention and initial diffusion) and will propagate within a small community of early adopters. Note the image above, depicting very low diffusion, even to a point the general masses dismissing the technology altogether. Amazingly it is contained within this tight group of people and industries for some period of time. That is until a tipping point is hit. Today, most people who have taken an Uber or Lyft ride – if given a choice – will only take uber from here on out.

Frenzy

Frenzy is a period of massive growth for a new technology. It is a time of new market creation as well as for rejuvenating old industries. Once a critical mass of consumers have been hit, the diffusion of the paradigm takes center stage. Individualism rules the land, as does speculation, wealth creation and ultimately resulting in over-investment flooding the market.

Frenzy is the later phase of the installation period. It is a time of new millionaires at one end and growing exclusion at the other, as in the 1880’s to 1890’s, the 1920’s and the 1990’s. In this phase, financial capital takes over; its immediate interests overule the operation of the whole system.

Notice the part about the growing polarization between the rich and the poor. Sound familiar? Capital investments soar during this time, creating a false sense of wealth creation. This craze attracts more and more individuals wanting to get a piece of the action; so late frenzy is financial bubble time.

Turning point

At some point, the bubble has to burst. Things that go up must come back down. Interestingly, the turning point is neither an event or a phase, rather it is a process of contextual change.

The turning point has to do with the balance between individual and social interests within capitalism. It is the swing of the pendulum from the extreme individualism of Frenzy to giving greater attention to collective well being, usually through the regulatory intervention of the state and the active participation of other forms of civil society.

The turning point is a space for social rethinking and reconsidering. It is, in fact, the time when the mode of growth that will shape the next few decades is defined. I would argue we have been in this phase for a while, maybe starting 5-8 years ago. After picking up the pieces of the crash of the early 2000’s we are now starting to see realignment in almost every industry known to man. Name an industry that is not currently being touched by the internet and mobile? Exactly.

Synergy

This is a time for production. Since the foundations and infrastructures were laid out during the previous phases, conditions are there for dynamic expansion and economies of scale. The diffusion of the new paradigm now reaches far and wide, is accepted as standard, and now governs supreme. It is a time for promise, work and hope. For many, the future looks bright.

Synergy is the early half of the deployment period. This phase can be the true ‘golden age’. It is likely to be the closest the system ever comes to convergence within the economy of the core countries of the system.

Mary Meeker anyone? She has identified this expansion phase quite eloquently, particularly in the mobile space. I would argue we are still at the turning point but on the cusp of this synergy phase. We should expect to observe massive expansion and economies of scale in almost every industry imaginable for the next few decades. New industries and markets will emerge. Old ones will finally die off. Will it be all golden? I am not so sure. But if history is any indication, we shall see an expansion of scale only experienced once every 60 or 70 years.

It was this exact point in the book which urged me finally jump off the fence and into my entrepreneurial pursuits full time.

Maturity

Once again, the cycle continues. Every paradigm has a shelf life and can only survive so long. As it enters maturity, deep questions are asked about the system and the climate is favorable for politics and ideological confrontation. Markets are saturating and technologies are maturing.

Gradually the paradigm is taken to its ultimate consequences until it shows up its limitations... yet all the signs of prosperity are still around. Those who reaped the full benefits of the ‘golden age’ continue to hold onto their belief in the virtues of the system and to proclaim eternal and unstoppable progress, in a complacent blindness, which could be called the ‘Great Society Syndrome’.

During maturity, the stage is set for the decline of the whole mode of growth and for the next technological revolution. Since we are entering a synergy phase, I will not spend much time on maturity. According to Perez, the next maturity phase should not be entered for quite some time and the decline of our current paradigm should not influence ones innovation or investment perspective. Yet it is always smart to keep an eye on something like this. Interestingly, it is in this period inventors and innovators are tinkering with what will eventually become the next great paradigm. This begs the question: What will supplant the internet? I would suggest not worrying much about the answer to that question and take advantage of the current conditions. According to Perez, it should be quite good for years to come.

The lesson I see here is to know that we are in a smaller bubble within a larger economic cycle. The smaller bubbles grow and pop fairly regularly with the net result of growth throughout the 60-70 year larger cycle. The key is to make sure you have made the correct decisions to protect yourself and your company from the small bubble gyrations.